Ladegerät für den Akku-Fensterreiniger WV 50 Plus Kärcher, Netzteil für Fenstersauger WV 50 Plus | Kärcher | Staubsauger Zubehör | Haushalt | Akkushop

WICKED CHILI 5,5V Ladekabel für Kärcher Fenstersauger WV6, WV5, WV1, WV2, WV50, WV71, WV4, WV70, WV52, WV60, WV75 Netzteil Kärcher, schwarz | MediaMarkt

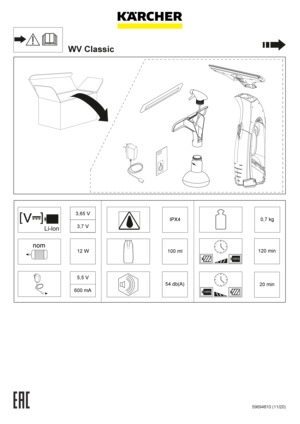

Kärcher Akku-Fenstersauger WV Classic (Akkulaufzeit: 20 min, Sprühflasche mir Mikrofaserbezug, Fensterreiniger-Konzentrat 20 ml) : Amazon.de: Baumarkt

Kärcher Netzteil für Fenstersauger WV 1, WV 2, WV 5, WV 50, WV Classic 2.633-107.0 - Endreß KG - Ihr Online-Shop für Heim-, Garten- und Werkstattgeräte

Kärcher WV 6 Premium + KV 4 PREMIUM INKL. REINIGUNGSMITTEL & VERLÄNGERUNG ab 173,99 € | Preisvergleich bei idealo.de

Kärcher Akku-Fenstersauger WV Classic (Akkulaufzeit: 20 min, Sprühflasche mir Mikrofaserbezug, Fensterreiniger-Konzentrat 20 ml) : Amazon.de: Baumarkt

Kärcher Akku-Fenstersauger WV Classic (Akkulaufzeit: 20 min, Sprühflasche mir Mikrofaserbezug, Fensterreiniger-Konzentrat 20 ml) : Amazon.de: Baumarkt

,type=downsize,aspect=fit;Crop,size=(450,450),gravity=Center,allowExpansion;BackgroundColor,color=ffffff;UnsharpMask,gain=1.0,threshold=0.05;&ausverkauft=2)