Flat-Plate Solar Collectors at Fleischwaren Berger for Boiler Feed-water Preheating | Interreg Europe - Sharing solutions for better policy

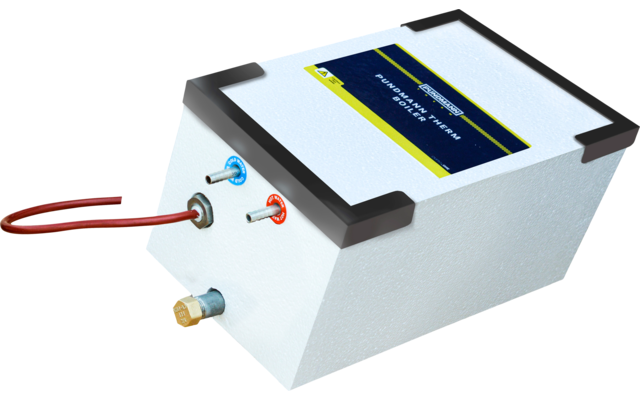

Truma Heizung Boiler Reparatur in Berlin - Neukölln | Hymer-Eriba Wohnwagen / Wohnmobil gebraucht | eBay Kleinanzeigen

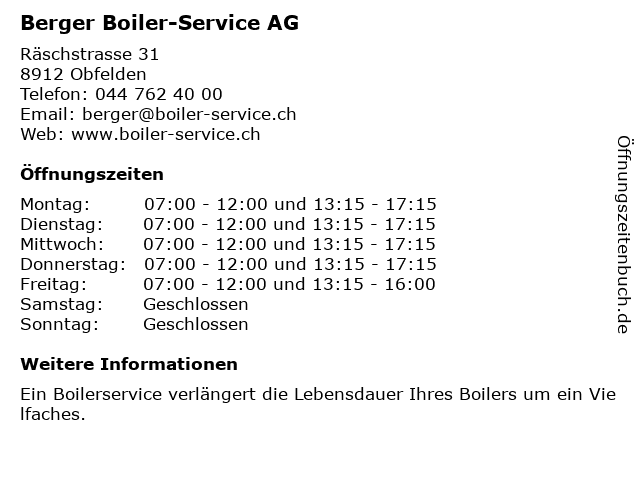

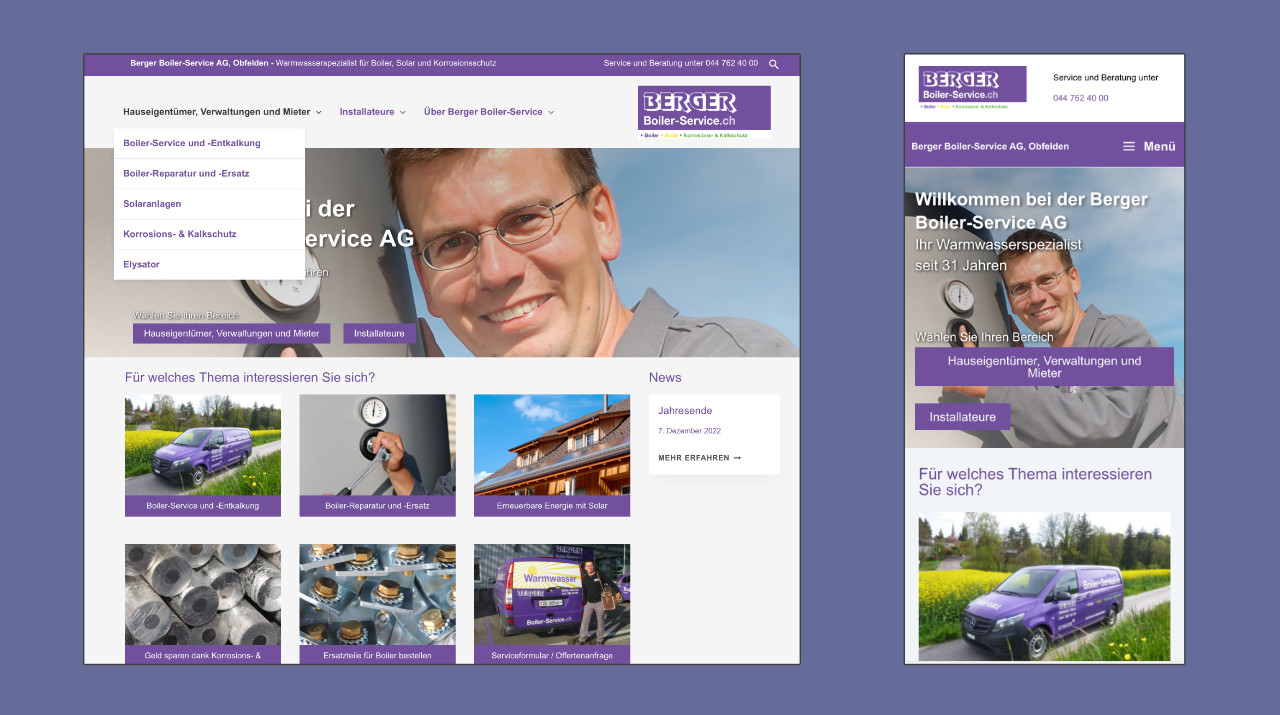

Berger Boiler mit neuer Website • stierli digital solutions GmbH - Webseiten - Google-Optimierungen - Web-Projekte