GFTIME 69787 45,7CM Edelstahl Brenner für Weber Spirit I & II 310 320, Spirit LX 310 Series Spirit E310 E320 S310 S320 SP330 mit 3 vorderen Brennerknöpfen (2013 - 2017), Grills Ersatzteile Brennerrohr

GFTIME 38,9cm Flavorizer Bar 7635 für Weber Spirit I E210/220 & II E210/S210 (mit vorderen Brennerknöpfen), Edelstahl Hitzeschild, Ersatzteile Aromaschienen, 3 Pack : Amazon.de: Garten

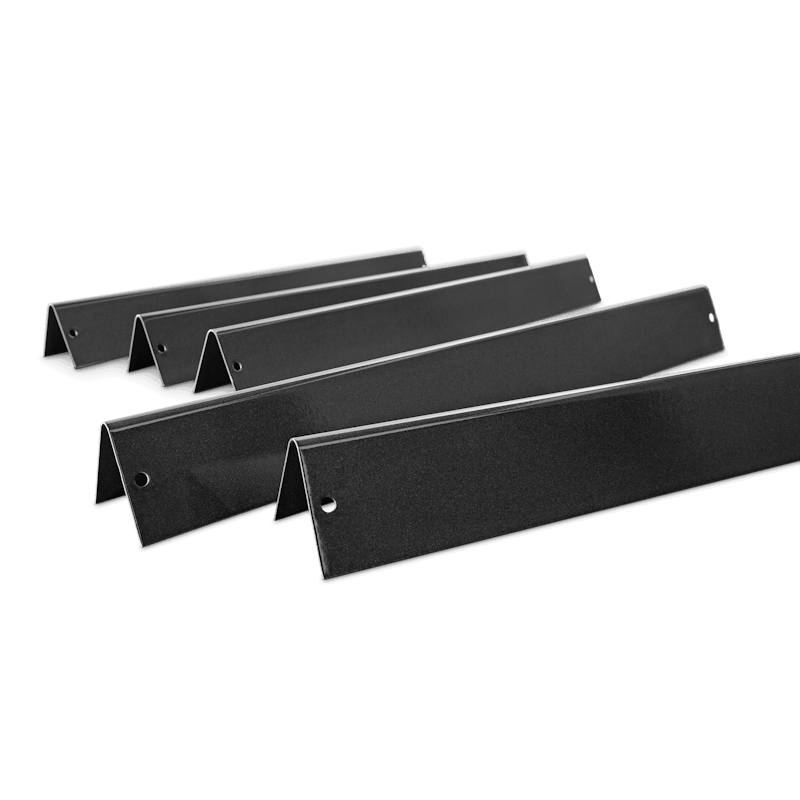

Onlyfire Flavorizer Bars Edelstahl Aromaschienen Flavorizer Bars Flammenblech für Weber Genesis II 300 Series Gas Grill (Bedienfeld an der Vorderseite) : Amazon.de: Garten

GFTIME 44,5cm 7621 Flavorizer Bars für Weber Genesis E/S-310 320 330 (2011-2016 mit vorderen Brennerknöpfen), Nicht Kompatible mit Genesis II Serie, Aromaschienen Ersatzteile 7620, 5 Pack : Amazon.de: Garten

Weber® Aromaschienen Flavorizer™ Bars Spirit™ 300-Serie (ab 2013), Edelstahl (5er Set) | Grillmarkt Radebeul

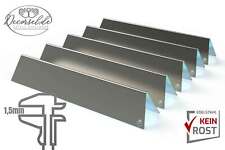

GFTIME 44,5cm Flavorizer Bars 7620 1,3mm Dicke für Weber Genesis E310 E320 S310 S320, E/S 330 (mit vorderen Brennerknöpfen), aromaschienen Ersatzteile 7621, passt Nicht für Genesis II/LX 310/340 : Amazon.de: Garten

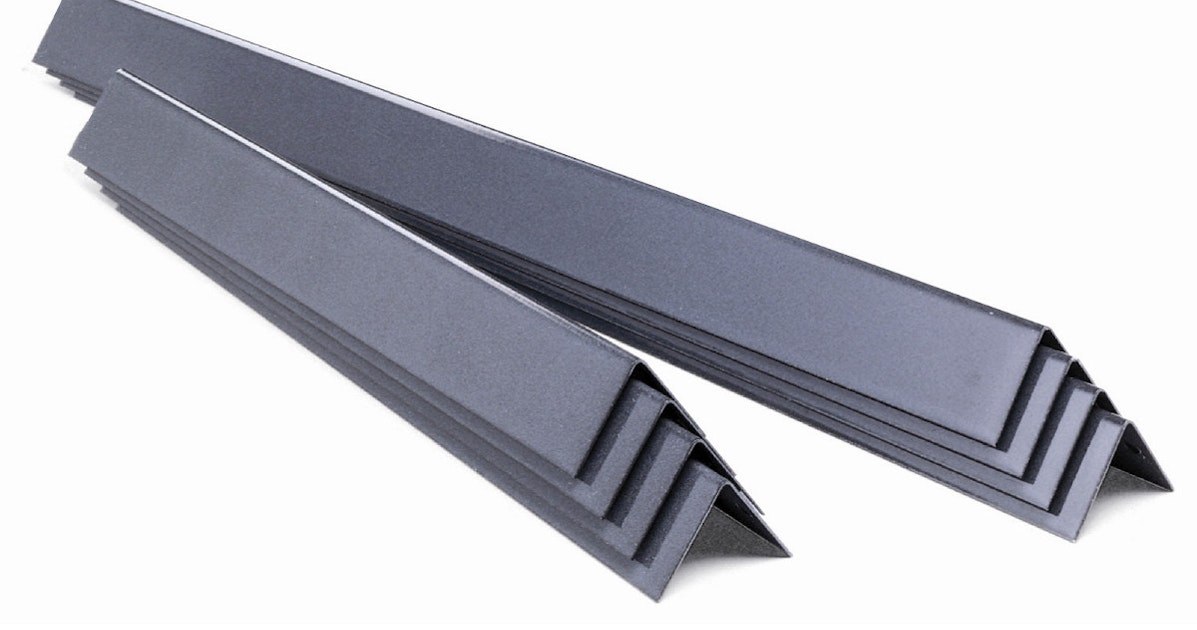

SANTOS Flammblech für Weber Gasgrills - versch. Grills der Weber Genesis Serie - 43,5x7,5x5,5cm - Edelstahl-Brennerabdeckung, Flammenverteilerblech