Ionic.Zip.ZipException: Cannot read that as a ZipFile · Issue #282 · GlitchEnzo/NuGetForUnity · GitHub

net - Using Ionic.Zip dll, Password Protected zip does not ask for password second time c# - Stack Overflow

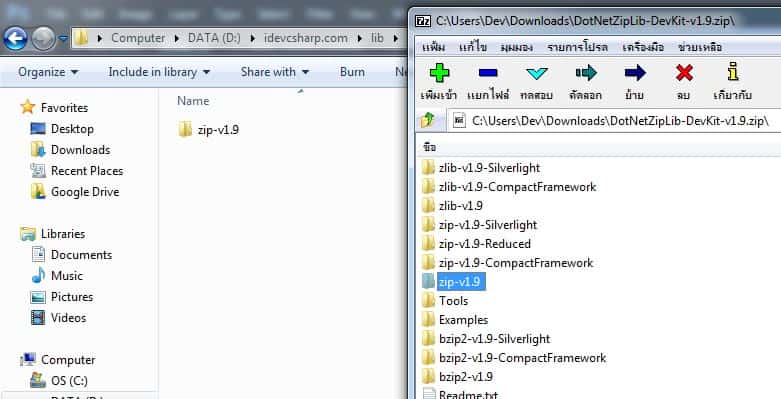

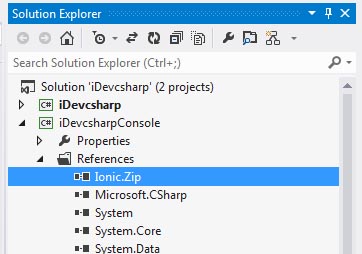

dotnetzip - How to add Ionic.Zip.dll in c#.net project and use it to create a zip from folder? - Stack Overflow

GitHub - fioletmouse/Ionic.Zip-example: Used for add pdf files from memory to archive (good for upload files from DB)

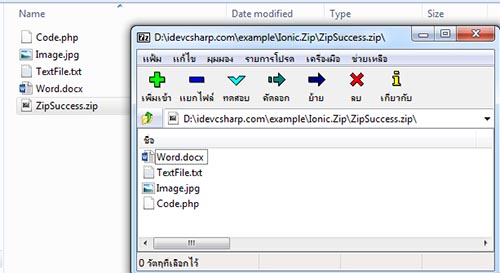

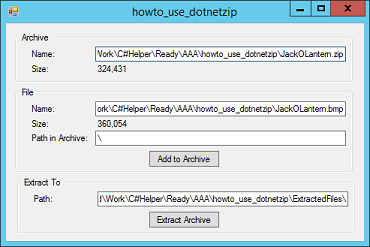

![Tips] How to Zip File, multiple file using C# programming language - Learn Tech Tips - Learn new tips in programming language Tips] How to Zip File, multiple file using C# programming language - Learn Tech Tips - Learn new tips in programming language](https://1.bp.blogspot.com/-uRVWd_uU7nE/Vt5RyHJk4cI/AAAAAAAACP0/YyuDGkEO7Ak/s1600/Using_ionic_Zip.png)

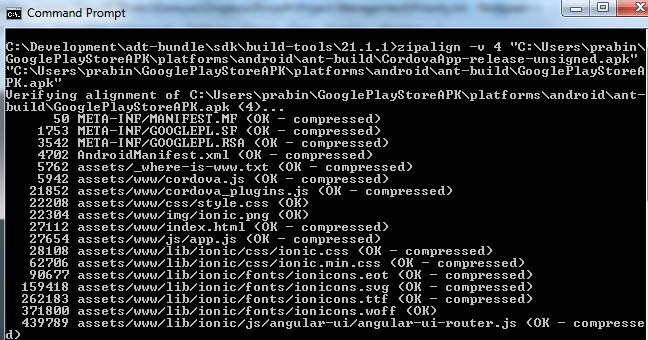

![c# - Compress File Using Ionic.ZIP with Progress Bar [Windows Forms] - Stack Overflow c# - Compress File Using Ionic.ZIP with Progress Bar [Windows Forms] - Stack Overflow](https://i.stack.imgur.com/TJVfZ.png)