Scorpion 500W hand saw RS890K-QS Black & Decker - PS Auction - We value the future - Largest in net auctions

Black+Decker 500W 3-in-1 Universal Saw Scorpion RS890K with Case, Includes 3M™ Protective Glasses for Machine Tools 2890S and 3M Peltor Optime Comfort Ear Protectors H510A (87 to 98 dB) : Amazon.de: DIY

Ножовка Black & decker RS890K-QS+Ножовка BDHT0-20178 по мет. - цена, фото - купить в Москве, СПб и РФ

Black+Decker Universal Säbelsäge in Thüringen - Geisa | Heimwerken. Heimwerkerbedarf gebraucht kaufen | eBay Kleinanzeigen

BLACK+DECKER RS890K-QS Sega Multifunzione Scorpion Autoselect, 500 W + X29972 HCS Lama Curva, Lunghezza di Taglio 100 mm : Amazon.it: Fai da te

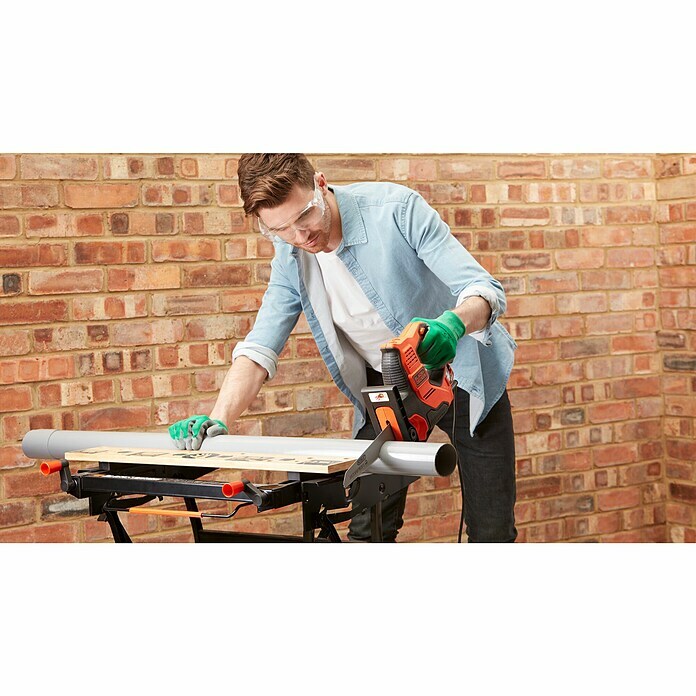

Black and Decker Scorpion autoselect universal 3-in-1 electric 500 W RS890K multi-purpose saw, hand-, jigsaw and pruning saw with case, 23 mm stroke length, black, red, RS890K-QS : Amazon.de: DIY & Tools

BLACK+DECKER RS890K-QS Sega Multifunzione Autoselect Scorpion con Tre Lame in Valigetta, 500 W, 0-2700 giri/min, Nero : Amazon.it: Fai da te

BLACK+DECKER RS890K-QS Scorpion® háromfunkciós elektromos kézifűrész, 500W, kofferben - MediaMarkt online vásárlás

Black and Decker Scorpion autoselect universal 3-in-1 electric 500 W RS890K multi-purpose saw, hand-, jigsaw and pruning saw with case, 23 mm stroke length, black, red, RS890K-QS : Amazon.de: DIY & Tools

Пила сабельная Scorpion RS890K-QS 500 Вт Black+Decker 7439534 купить в интернет-магазине Wildberries