Weihnachtsbannd Jute creme Frohe Weihnachten 10cm ohne Draht jetzt günstig kaufen | christa-baender.de

Satinband Rot Breit 10cm x 20M, Geschenkband Schleifenband, Rot Satin Band Dekoband, Weihnachten Red Ribbon, Stoffband Ringelband für Hochzeit Geburtstag Party Deko Basteln Verpackung (A) : Amazon.de: Küche, Haushalt & Wohnen

FAKILO Geschenkband 10cm Breit Satinband Weiß Band für Grand Öffnung, Eröffnungszeremonie, Schleifenband Ringelband für Weihnachten Hochzeit Geburtstag Valentinstag Deko : Amazon.de: Küche, Haushalt & Wohnen

FAKILO Geschenkband 10cm Breit Satinband Grün Band für Grand Öffnung, Eröffnungszeremonie, Schleifenband Ringelband für Weihnachten Hochzeit Geburtstag Valentinstag Deko : Amazon.de: Küche, Haushalt & Wohnen

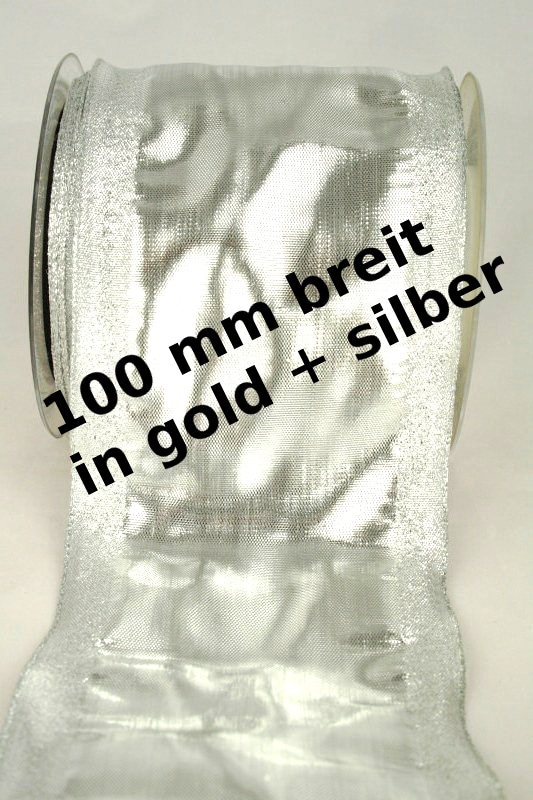

Extrabreites Gold- und Silber-Band in 100 mm Breite, mit Drahtkante günstig kaufen | Weihnachtsband gold + silber von Geschenkband Discount

Amazon.de: CaPiSo 22m Satinband 100 mm Schleifenband 10cm Breite Geschenkband Tischläufer Dekoband Dekoration Weihnachten Hochzeit: Rot

Yuragim Satinband, 10cm x 20m Claret Dunkles Rot Breit Geschenkband Schleifenband, Stoffband für Hochzeit, Großes Band Satinband Weiss für Hochzeit Taufe Geburtstag Geschenkverpackung Party Dekoration : Amazon.de: Küche, Haushalt & Wohnen

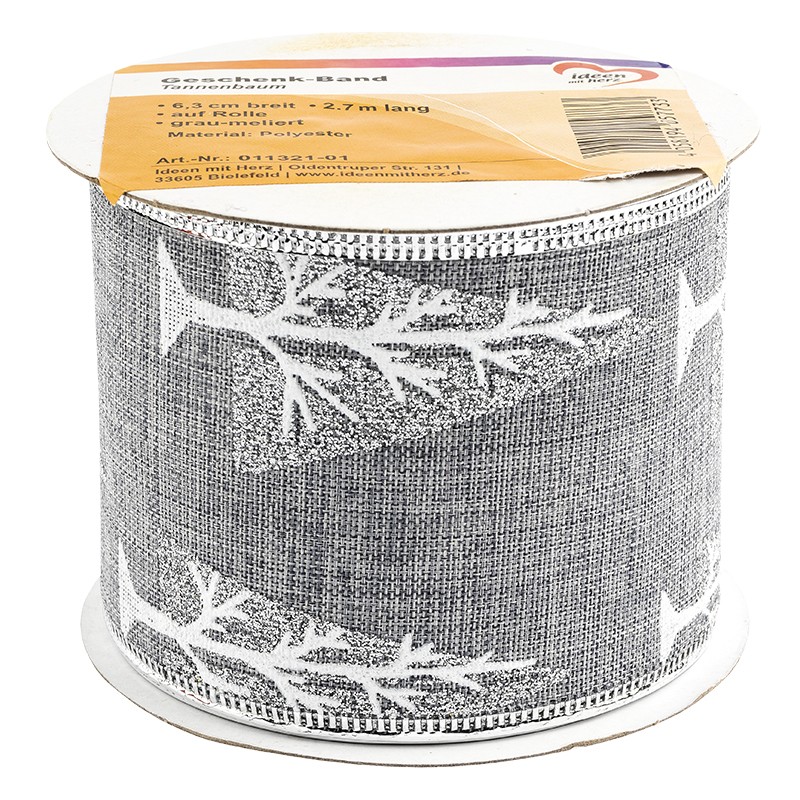

Geschenk-Band, Tannenbaum, 6,3cm breit, 2,7m lang, grau-meliert | Schleifenband | Deko-Artikel | Deko- & Geschenkartikel | Ideen mit Herz

2 Stücke 10cm x 20M Geschenkband Satinband Rot Poly schleifenband breit, Rotes einfarbiges Stoffband Satin Dekoband Geschenkbänder, Satinbänder für Dekoration Weihnachten Geburtstag Geschenkschleife : Amazon.de: Küche, Haushalt & Wohnen

ZYOOO 10cm * 22m Satinband Grün Breit - Schleifenband Geschenkband Dunkelgrün zum Hochzeit Geschenk Dekoration : Amazon.de: Küche, Haushalt & Wohnen