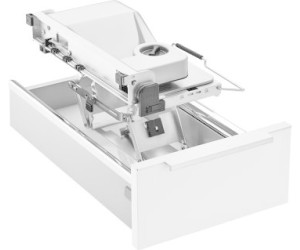

Ritter AES 52 S Montageset für den Einbau-Allesschneider AES 52 S : Amazon.de: Küche, Haushalt & Wohnen

Ritter AES 72 SR Allesschneider in hochwertiger Vollmetallausführung für Schublade ab 45 cm / Schneidemaschine / Allesschneider / RITTER / Brotmaschine | KitchenKing24

Ritter Schubladen Brotmaschine Einbau-Allesschneider AES 52 S in Hessen - Frankenau | eBay Kleinanzeigen

Schinkenmesser Ritter E 16 - Ritter E 18 - Ritter E 19 - Ritter E 21 - Ritter Fondo 1 - Ritter Fortis 1 - Ritter Pino 2 - AES 52 S - AES 62 SL/SR - AES NR/NS Allesschneider mit lila Zahnrad

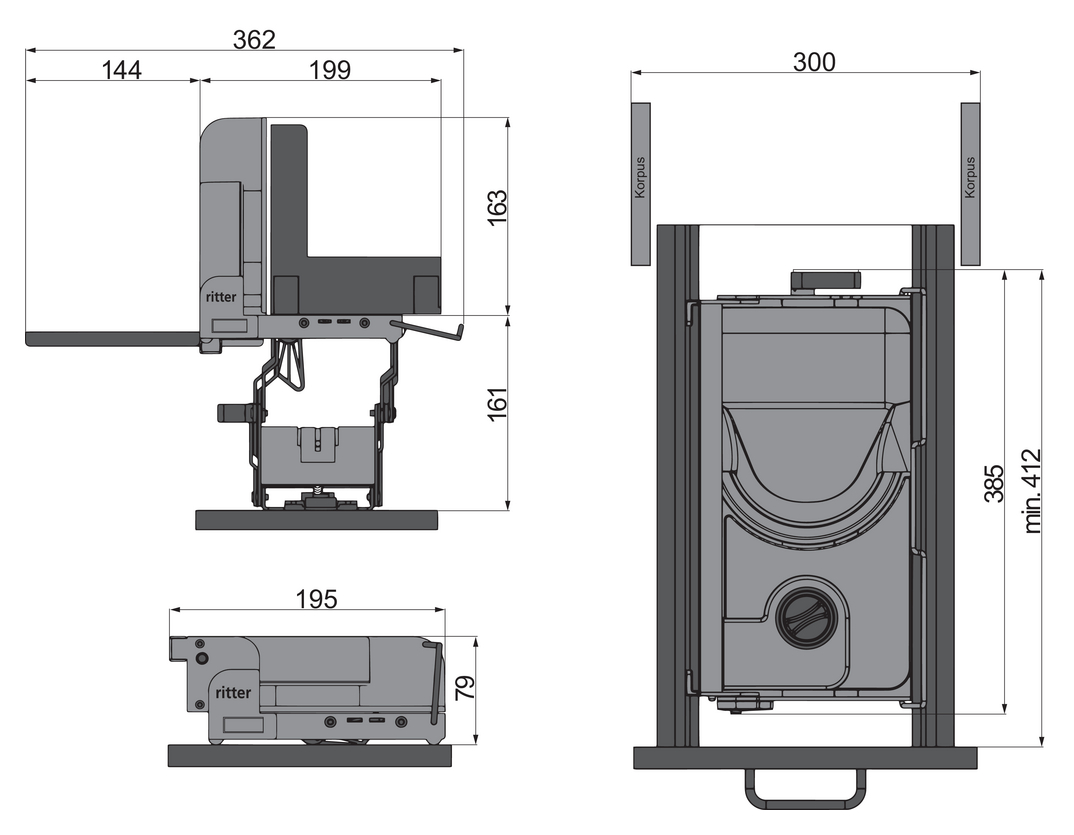

Naber Storex RITTER MultiSchneider 3 Typ AES 52 Metallgehäuse silber 1111043 Online Shop Zubehör Allesschneider

Restehalter für den Ritter Allesschneider AES 52 S / Multischneider / Ersatz-Restehalter / Ersatztei online kaufen | eBay