MAM Schnuller Original S161 Schnuller mit Latexsauger, für Babys von 6 Monaten, Rosa (2 Stück) mit Auto-Sterilisierbox, spanische Version : Amazon.de: Baby

MAM Schnuller Original Pure plain Silikon grün/creme, 0-6 Monate, 2 St dauerhaft günstig online kaufen | dm.de

MAM Perfect Silikon Schnuller 0-6 Uni Mix // 2er Set // inkl. Transport- Sterilisierbox // Dento-Flex : Amazon.de: Baby

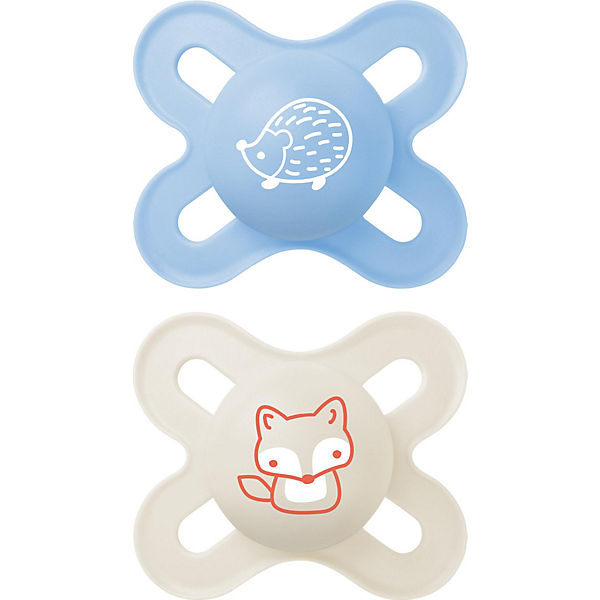

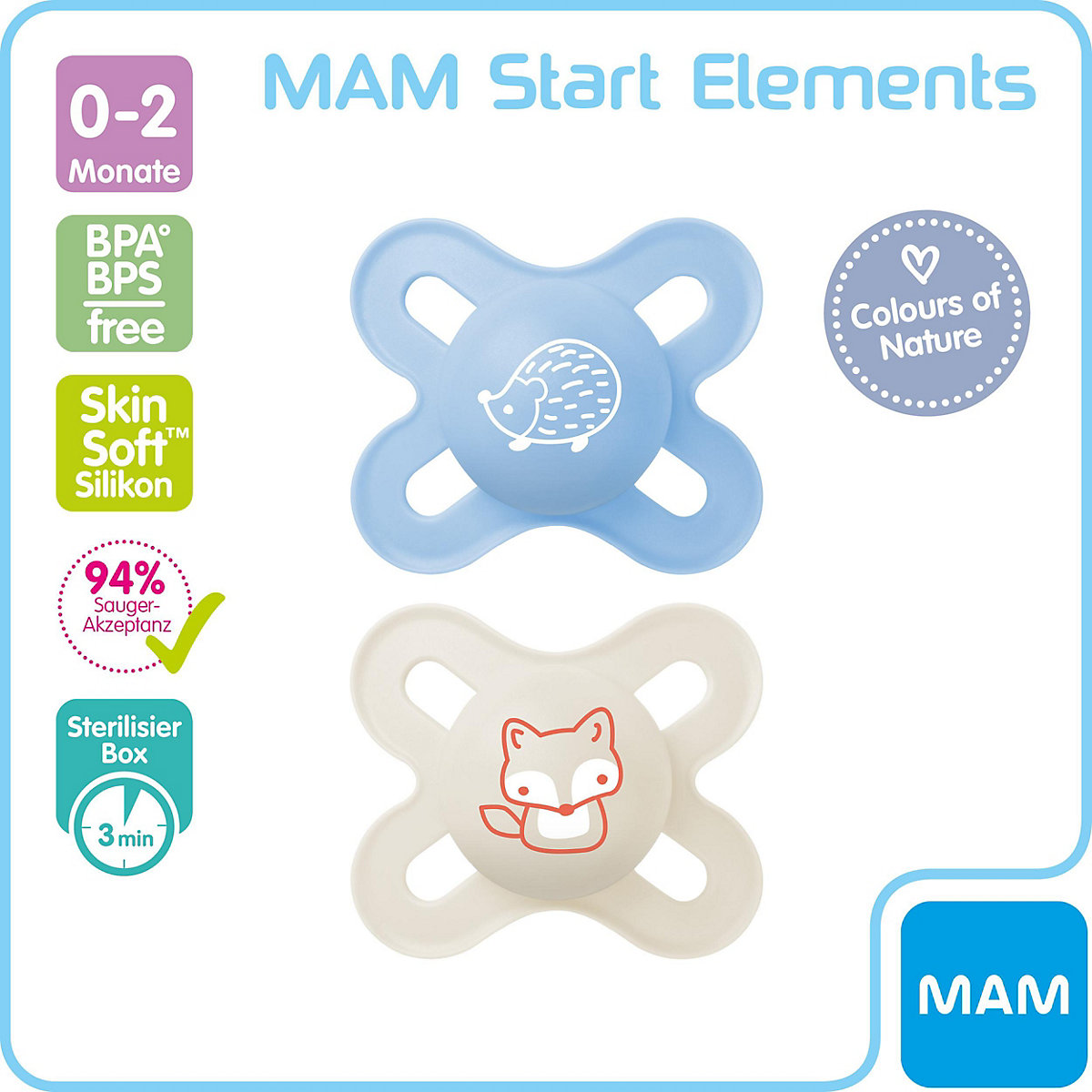

MAM Schnuller 0-2 Monate, 2er Set mit Sterilisierbox in Baden-Württemberg - Rheinhausen | Babyausstattung gebraucht kaufen | eBay Kleinanzeigen

MAM Perfect Silikon Schnuller 0-6 Uni Mix // 2er Set // inkl. Transport- Sterilisierbox // Dento-Flex : Amazon.de: Baby