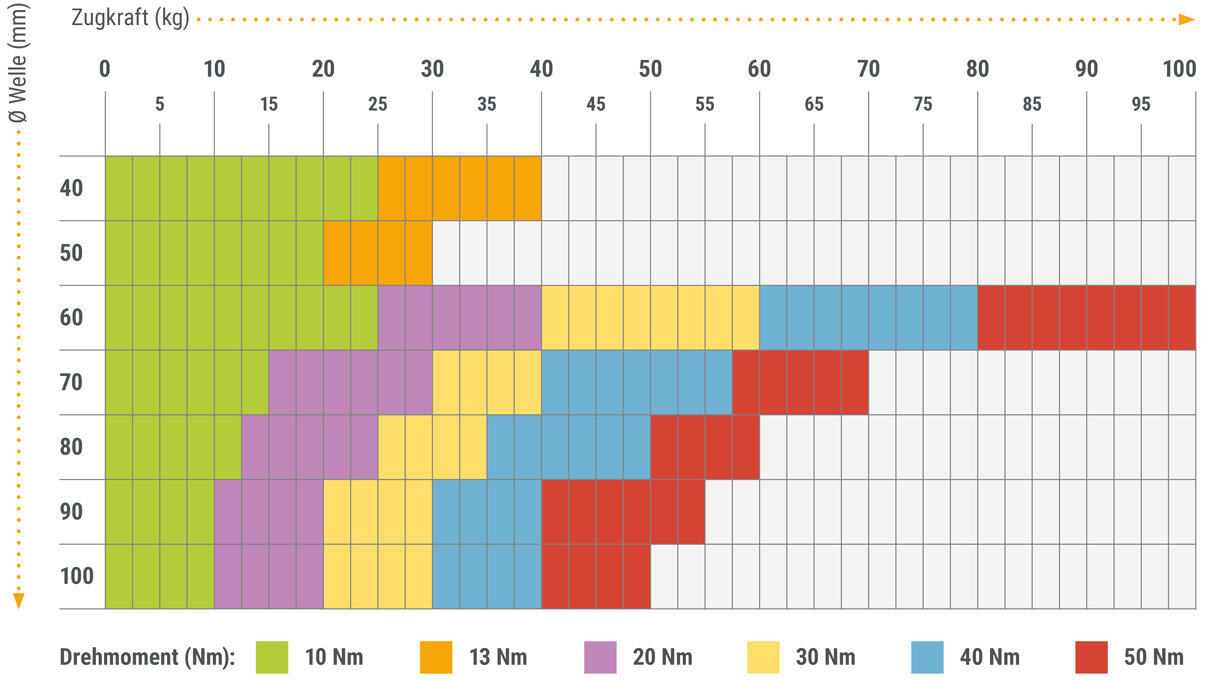

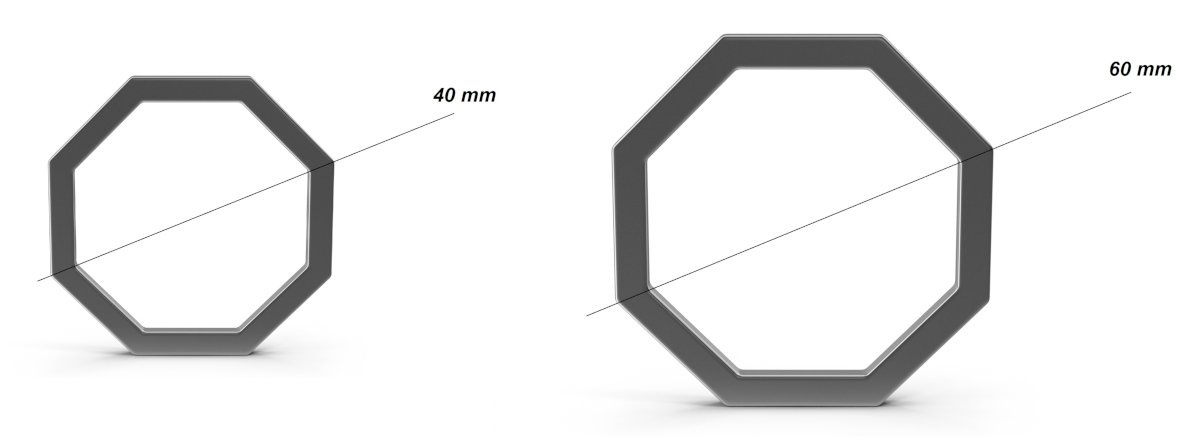

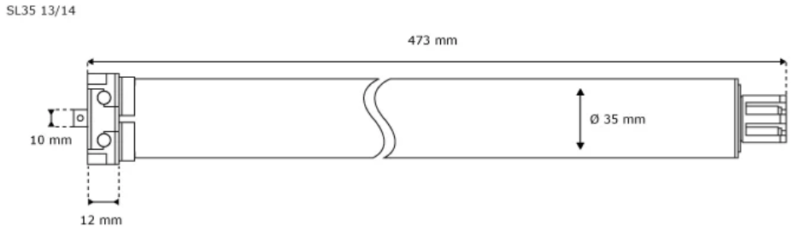

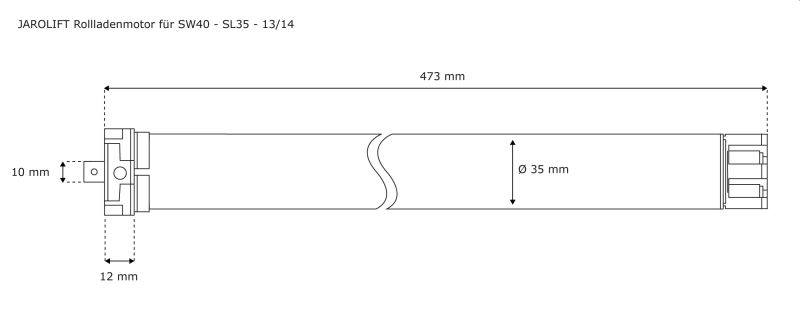

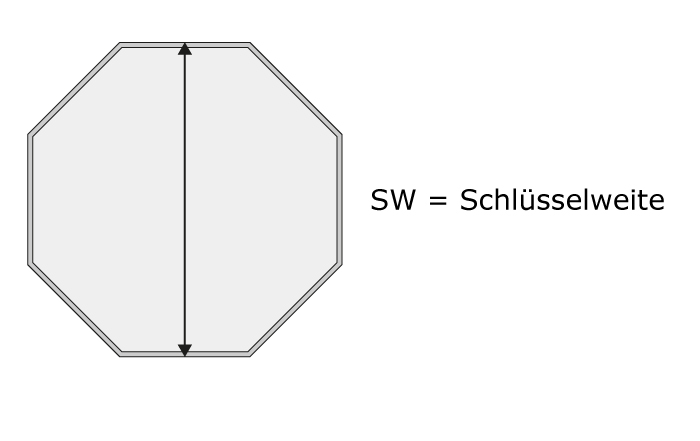

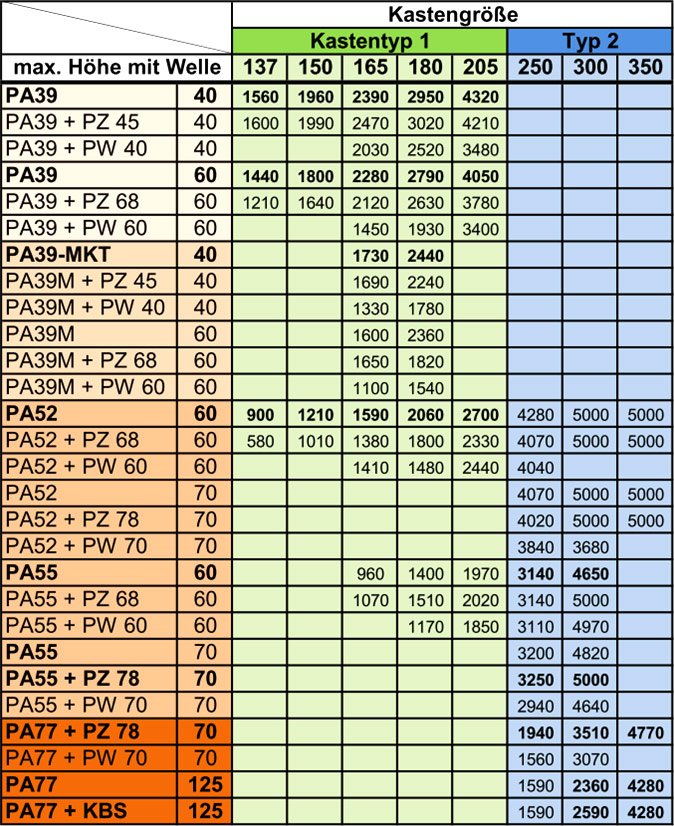

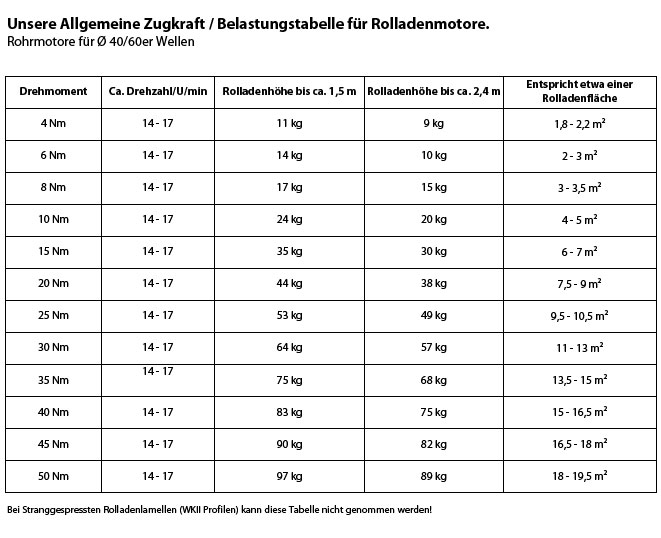

3T-MOTORS Rollladenmotor 3T35-10SD (Zugkraft 10 Nm/25 kg) für 40 mm 8kant Rollladenwelle (SW40), mit mechanischen Endschaltern, einfache Montage, Rollladenantrieb, Kurzmotor : Amazon.de: Baumarkt

Becker Rolladenmotor, für große Rollos in Nordrhein-Westfalen - Ennepetal | eBay Kleinanzeigen ist jetzt Kleinanzeigen

NOBILY Profi-Set/Maxi - Rolladenmotor Rohrmotor Rolladenantrieb P5 30/15-60 (Zugkraft 75kg) + Vestamatic Time Control Zeitschaltuhr : Amazon.de: Baumarkt

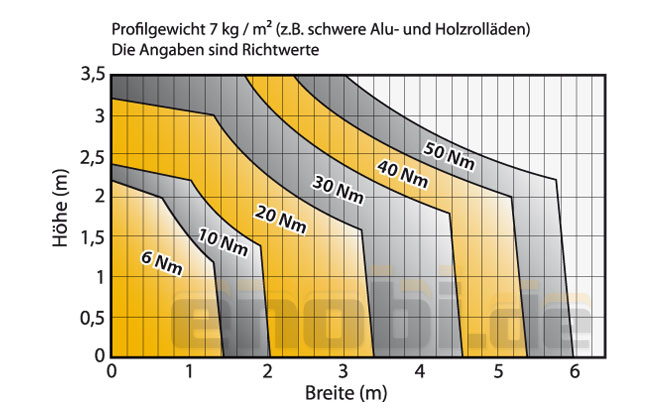

Schellenberg 20615 Rolladenmotor MAXI Standard 15 Nm, mechanische Endlageneinstellung, Rohrmotor für 60 mm Welle, bis 6,2 m² Rollladenfläche, Set inkl. Wandlager : Amazon.de: Baumarkt