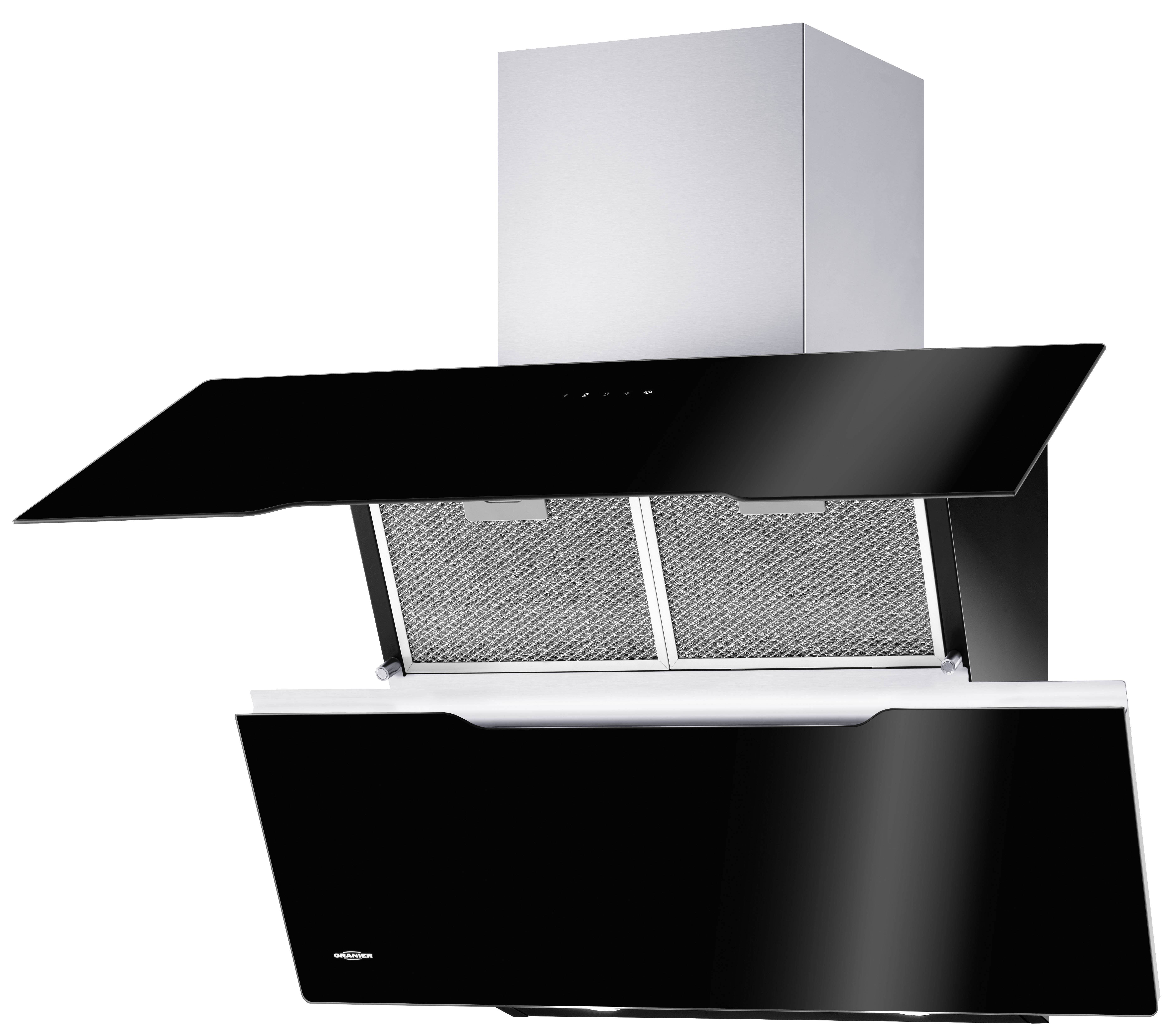

Oranier Lito² 75 S Kopffrei Dunstabzug Schwarzglas/Edelstahl, EEK A Online Shop Dunstabzugshaube Kopffrei Hauben

Oranier Vivio 60 S Kopffrei Dunstabzug Schwarzglas/Edelstahl, EEK A Online Shop Dunstabzugshaube A +++ Kopffrei Hauben

Oranier Meba² 60 W Kopffrei Dunstabzug Weißglas/Edelstahl, EEK A Online Shop Dunstabzugshaube Kopffrei Hauben

Oranier Scala 90 S Kopffrei Dunstabzug Schwarzglas/Edelstahl, EEK B Online Shop Dunstabzugshaube A +++ Kopffrei Hauben

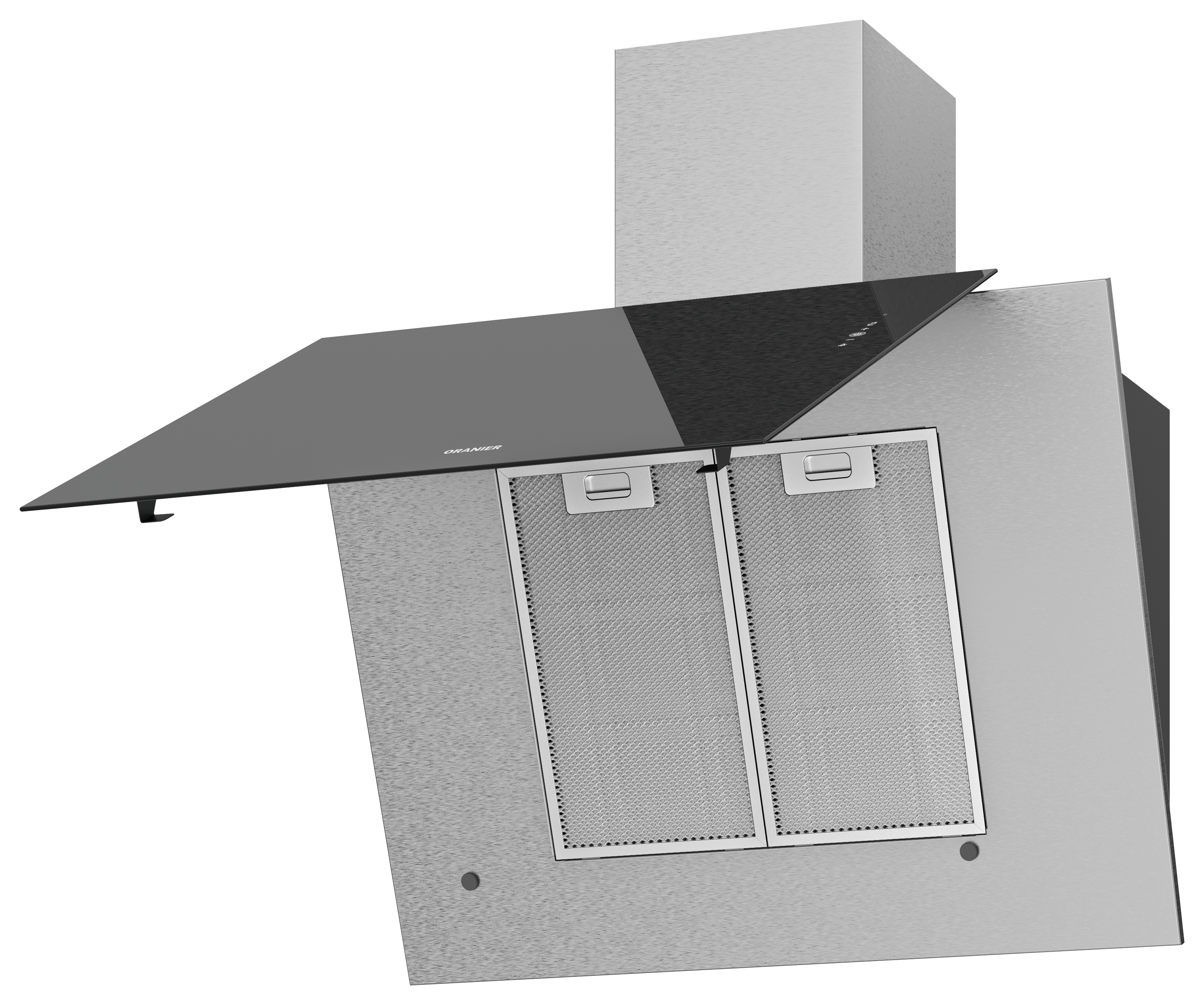

Oranier kleine schwarze kopffreie Wandhaube 60 cm Umluftbetrieb Signa - effektive Dunstabzugshaube im Schräghauben Design : Amazon.de: Elektro-Großgeräte

Oranier Signa 75 W Kopffrei Dunstabzug Weißglas/Edelstahl, EEK B Online Shop Dunstabzugshaube A +++ Kopffrei Hauben