Bautrockner / Entfeuchter für 100 m², max. 35 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 140 m², max. 70 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 40 m², max. 30 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 40 m², max. 30 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 40 m², max. 30 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 100 m², max. 40 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 240 m², max. 125 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 56 m², max. 40 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 188 m², max. 75 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner, Luftentfeuchter mieten in Wolfenbüttel in Niedersachsen - Wolfenbüttel | eBay Kleinanzeigen

Bautrockner und Bauventilatoren zu mieten in Nordrhein-Westfalen - Neuenrade | Heimwerken. Heimwerkerbedarf gebraucht kaufen | eBay Kleinanzeigen

Bautrockner / Entfeuchter für 120 m², max. 60 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Entfeuchter für 28 m², max. 24 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

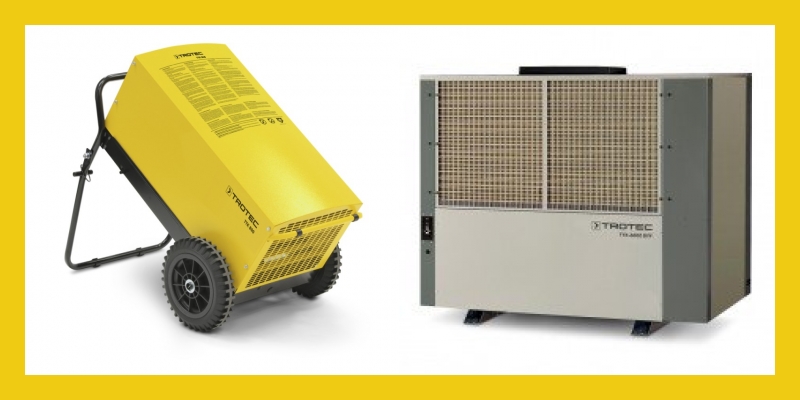

Bautrocknung in Roh-Ausbau, Renovierung | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Bautrockner / Entfeuchter für 40 m², max. 16 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih

Rentas Mietgeräte Wetzlar - Bautrockner/Luftentfeuchter Mieten in eurem Rentas Mietgeräte Center Wetzlar. | Facebook

Bautrockner / Entfeuchter für 188 m², max. 75 l/24 h | Rentas Mietgeräte, Werkzeugvermietung, Maschinenverleih und Geräteverleih